When a church building is sold, it often raises questions about where the money goes. Church properties hold sentimental and spiritual value, but they can also have substantial financial worth. Understanding the process and the parties involved in the sale of a church building is essential for both church members and the wider community. In this article, we will delve into the topic and shed light on who receives the proceeds when a church building is sold.

If a Church Building Is Sold Who Gets the Money?

1. The Church Congregation and Leadership

The Church Congregation and Leadership

When a church building is sold, the initial claim to the proceeds typically lies with the church congregation and its leadership. This is especially true if the church is an independent entity without ties to a larger denominational organization. However, how the money is utilized depends on the church’s specific bylaws, governing documents, and any legal or financial obligations.

Utilization of Proceeds

Repurposing or relocation: The congregation may choose to use the funds to purchase or build a new church facility in a more suitable location or repurpose an existing property for worship and community activities. For example, a growing congregation may sell its smaller building to acquire a larger space that can accommodate its expanding membership.

Debt retirement: If the church has outstanding debts, such as mortgage loans or construction loans, the proceeds from the sale can be used to pay off these financial obligations. This allows the church to start anew without the burden of existing debts and can provide a fresh financial foundation for future endeavors.

Ministry expansion: Some congregations opt to allocate a portion of the proceeds to support outreach programs, missions, or community initiatives that align with the church’s values and mission. For instance, the funds may be used to establish programs for feeding the homeless, providing educational resources to underprivileged children, or offering counseling services to those in need.

2. Denominational Organizations

Denominational Organizations

In cases where the church is affiliated with a larger denominational organization, the proceeds from the sale may be subject to specific guidelines and regulations set by the denomination. These guidelines are usually outlined in the governing documents of the denomination, which can include rules regarding the distribution of funds.

Distribution of Funds:

Denominational purposes: The proceeds may be used to support broader denominational initiatives, such as funding new church plants, providing assistance to struggling congregations, or supporting educational programs and seminaries within the denomination. For example, the funds could be directed toward starting a new church in an underserved area or helping a struggling congregation maintain its operations.

Redistribution to local congregations: Some denominations have policies in place to redistribute a portion of the funds back to local congregations based on certain criteria, such as size, financial need, or specific project proposals. This redistribution can help smaller congregations that may not have the same financial resources as larger ones. For instance, a denomination might allocate funds to assist a smaller church in renovating its facilities or developing programs for youth outreach.

3. Legal and Financial Obligations

Legal and Financial Obligations

The sale of a church building involves addressing various legal and financial obligations to ensure a smooth transition and proper allocation of funds. These obligations may include settling outstanding debts, addressing liens on the property, and complying with local laws and regulations.

Debt Settlement:

If the church has any outstanding debts, such as mortgages, construction loans, or other financial obligations, the proceeds from the sale can be used to pay off these debts. This ensures that the church fulfills its financial responsibilities and avoids any legal complications. For instance, if a church took out a loan to finance the construction of its building, the sale proceeds can be used to pay off the loan balance.

Liens and Legal Compliance:

Before the sale can be finalized, it is essential to address any liens or legal issues related to the property. This involves conducting thorough title searches, resolving any claims or disputes, and ensuring compliance with local laws and regulations governing property transactions. For example, if there are outstanding tax liens on the property, the sale proceeds may need to be used to satisfy those liens before distributing the remaining funds.

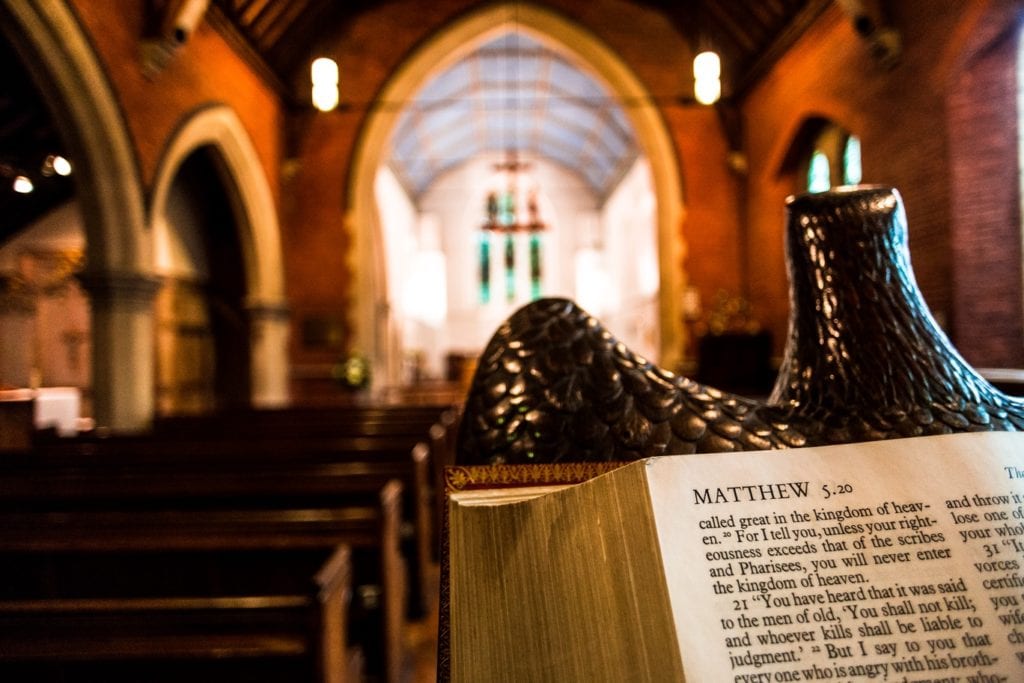

Scripture Example – Acts 5:1-11

In the Bible, we find an example of the importance of financial integrity within the early church. In Acts 5:1-11, Ananias and Sapphira sold a piece of property but withheld a portion of the proceeds while pretending to give the full amount. As a result, they faced severe consequences for their deceit. This passage emphasizes the need for transparency, honesty, and responsible handling of finances within the church community.

Tax Implications

The sale of a church building may have tax implications that need to be considered. Depending on the jurisdiction and the specific circumstances of the sale, there may be capital gains tax or other taxes applicable. It is important to consult with tax professionals to understand and comply with the tax obligations associated with the sale.

Property Tax Exemptions

In some regions, church properties may have enjoyed property tax exemptions due to their religious status. However, when a church building is sold, the new owner may not qualify for the same tax exemption. It is essential to evaluate the potential property tax implications both for the church during the sale and for the new owner after the transaction.

4. Consideration of Church Bylaws and Governance

Consideration of Church Bylaws and Governance

The church’s bylaws and governance structure play a significant role in determining the distribution of funds from the sale of a church building.

Bylaws Provisions on Property Sales

Churches typically have bylaws or governing documents that outline the procedures for selling church property. These provisions may include specific instructions on how the proceeds should be allocated and who has the authority to make those decisions.

Congregational vote

For example, some churches may require a congregational vote to determine the allocation of funds from the building sale. This ensures that the decision is made collectively, with input from the entire congregation.

5. Financial Accountability and Transparency

Financial Accountability and Transparency

Maintaining financial accountability and transparency is essential when dealing with the proceeds from the sale of a church building. It ensures trust and fosters a sense of stewardship among the congregation and the broader community.

Independent Financial Oversight

Establishing an independent financial oversight committee or board can provide an extra layer of accountability. This committee can review financial transactions, ensure compliance with legal and regulatory requirements, and provide transparency in the handling and distribution of funds.

Financial Reporting and Auditing

Regular financial reporting and auditing processes should be implemented to ensure transparency and accountability. These reports should outline the sources of income, expenses, and the allocation of funds from the sale. Conducting annual financial audits by qualified professionals can further reinforce the church’s commitment to transparency and responsible financial management.

6. Support for Church Staff and Programs

Support for Church Staff and Programs

When a church building is sold, it is important to consider the welfare of the church staff and the continuity of existing programs. Allocating a portion of the sale proceeds to support staff members and maintain essential ministries can be a priority for many churches.

Staff Severance and Relocation

If the sale of the building results in staff layoffs or relocations, it is crucial to provide adequate severance packages, and assistance with job placement, or relocation expenses. This demonstrates the church’s commitment to its employees and ensures a smoother transition for both the staff and the congregation.

Program Continuation

Churches may allocate funds to support the continuation of vital programs, such as children’s ministries, worship services, and community outreach initiatives. By providing financial stability during the transitional period, the church can maintain its impact and continue serving its congregation and the community effectively.

7. Consideration of Charitable Objectives and Missions

Consideration of Charitable Objectives and Missions

When a church building is sold, it is essential to consider the charitable objectives and missions of the church. This involves identifying how the proceeds can be utilized to support and advance these objectives.

Funding Charitable Activities

The funds from the sale can be allocated toward charitable activities that align with the church’s mission. This may include supporting community outreach programs, providing aid to the less fortunate, or funding educational initiatives that benefit the local community.

Homeless Shelter

For instance, a church may use a portion of the proceeds to establish or support a homeless shelter within the community. This not only addresses a pressing societal need but also reflects the church’s commitment to serving the marginalized and vulnerable.

8. Consideration of Community Impact

Consideration of Community Impact

When a church building is sold, considering the impact on the local community is vital. The distribution of funds should take into account the needs and aspirations of the community surrounding the church.

Investing in Community Development

A portion of the sale proceeds can be invested in community development initiatives. This may include partnering with local organizations to enhance education, healthcare, or other essential services in the community.

Youth Programs

For example, the church may allocate funds towards the establishment or expansion of youth programs that provide mentorship, academic support, or recreational activities for local children and teenagers. By investing in the youth, the church can positively impact the community’s future.

Understanding the Complexities of Church Building Sales

Who Receives the Proceeds When a Church Building is Sold?

Selling a church building involves navigating complex considerations related to ownership, denominational affiliations, and trustee management. Let’s delve into three common scenarios and discover who ultimately benefits from the sale.

First Scenario – Independent Congregations

Autonomy and Ownership

In independent congregations, the church members often have complete autonomy over their church buildings. This means that the ownership of the building rests with the congregation itself. So, when a church building is sold in such cases, the proceeds generally go directly to the church members.

Distribution among Congregational Members

The distribution of the sale proceeds among congregational members can vary based on the governing structure and bylaws of the church. Some churches choose to distribute the funds equally among the members, ensuring that each individual receives a fair share. This approach allows the members to benefit directly from the sale of the building.

For example, let’s consider a hypothetical independent church called Grace Community Church. If the church building is sold for $500,000, and there are 100 members, each member would receive $5,000 from the proceeds of the sale.

Alternatively, churches may decide to allocate the funds for specific purposes that align with their mission and vision. This could involve using the money to finance the construction of new worship facilities, supporting community outreach programs, or contributing to charitable initiatives.

Second Scenario – Denominational Churches

Denominational Ownership and Control

Denominational churches operate within a hierarchical structure, where a higher governing body oversees multiple churches. In this scenario, the ownership of the church building usually belongs to the denomination itself rather than the individual congregation.

Allocation of Funds

When a denominational church building is sold, the proceeds are typically utilized according to the policies and guidelines established by the governing body of the denomination. The denomination may have specific guidelines in place to ensure the funds are used in ways that benefit the wider religious community.

For instance, the proceeds from the sale may be directed towards supporting other churches within the denomination that are in need of financial assistance. The funds could also be used for investing in new church development projects, such as establishing new congregations or upgrading existing facilities. Additionally, the denomination might allocate the funds to contribute to denominational programs and initiatives aimed at promoting religious education, missions, or social outreach.

Third Scenario – Trustee Management

Church Property Trustees

In some cases, church buildings are managed by a board of trustees specifically appointed to oversee property matters. These trustees act as custodians, responsible for making decisions related to the sale of the building.

Distribution as Per Trustee Decisions

When a church building is sold under the supervision of trustees, the distribution of the proceeds is determined by the decisions made by the board. The trustees consider various factors, including outstanding debts, maintenance costs, or investments in other properties, when deciding how to allocate the funds.

For example, if the church has significant outstanding debts, the trustees may prioritize using a portion of the proceeds to pay off those debts before distributing the remaining funds. They might also allocate some funds for ongoing maintenance and repairs of other church properties. Alternatively, the trustees could decide to invest the funds in acquiring new properties or real estate that would benefit the church community in the long run.

Conclusion

Selling a church building involves navigating legal and financial complexities, and determining the distribution of sale proceeds requires careful consideration. Local laws, church governing documents, denominational affiliation, and the purpose of the church all play a role in deciding how the money is allocated. By understanding these factors and engaging in transparent decision-making processes, churches can ensure the equitable distribution of funds while honoring their obligations and missions.

I believe that all proceeds from a sale of a church should go to missions

Education is so essential to development and when there is an opportunity for someone to break the cycle of poverty often Education is the key . Low level of education most of the youth of the community have Low education standards. This make them find it very difficult to read and understand issues and events that happen.